Tourist tax income to be used for 'events like Oasis'

Reuters

ReutersMoney made from plans to charge people a tax to stay in Cardiff will be used to host major events such as this year's Oasis reunion concerts, the council leader has said.

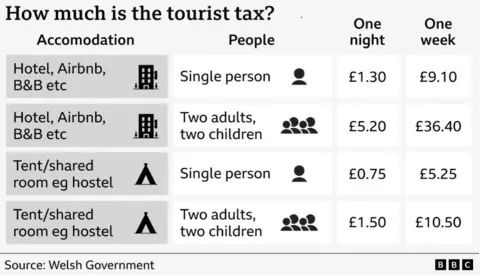

The capital is the first area in Wales to launch an official consultation on proposals that would add up to £1.30 per person to the cost of overnight accommodation in the city.

Cardiff council leader Huw Thomas said about £3.5m would be raised annually from the tourist tax.

Hospitality businesses want assurances that the consultation will listen to the industry, and spend the revenue on improving the city.

"We want to grow the tourist economy in Cardiff, we want to see more people come to our city, but we also want to be able to have the resource to give those visitors a great time," Mr Thomas said.

The council has launched a consultation with a view to introducing the levy in April 2027.

He said the money raised would help to "make sure that the impact on the local communities can be managed and mitigated" when major events are held in the city.

Revenue from the levy is "certainly not going to be used to plug gaps elsewhere in council directorates," he added.

"We want to market ourselves internationally and attract new events and new opportunities to the city as well, and having that income via a visitor levy gives us the funding to do so."

Cardiff's proposal follows Welsh government legislation enabling councils to introduce a levy from April 2027, provided they complete a consultation.

Cardiff is the first of Wales' 22 councils to launch a full public consultation, while others remain undecided. Anglesey, Blaenau Gwent and Conwy are among those preparing similar steps, but authorities such as Monmouthshire and Pembrokeshire have ruled it out.

Mr Thomas said English cities were "looking at us with a bit of envy" over the opportunities created by the levy.

While the money raised from the Cardiff levy will be decided following the public consultation, there are already calls to increase the presence of city centre wardens.

"This visitor levy would enable us to have a bigger presence," said warden manager Dave Sultana.

His team currently acts as a "high visibility presence" in the city, particularly during busy events.

Mr Sultana said the wardens were "like a mobile tourist information board" and that additional funding would pay for a "bigger team, and more hours on the streets" to help visitors and Cardiff locals.

They currently work Tuesday to Saturday, with some existing additional funding to cover Friday and Saturday nights up until 9pm.

Hospitality and accommodation providers are being encouraged to contribute to the consultation before any final decisions are made.

"The businessman in me says 'why would you put barriers up?'," said Nick Newman, who runs a number of hospitality businesses and is a director of the city's business improvement district, For Cardiff.

But he said he "understood where Cardiff council was coming from" and wanted assurances that the proceeds of the levy would be spent on "brightening the city up, making it clean and more attractive to visitors".

Mr Newman said it was "really important" that people engaged with the public consultation before the council went ahead with the levy, adding that they need to "get the process right, get the consultation right, and get the spending right".

While last month's budget gave powers to English mayors to launch their own tourist taxes, some schemes are already up and running.

Which UK cities have a tourist tax?

- Manchester became the first city in the UK to introduce a tourist tax in 2023. The £1 per room, per night fee raised about £2.8m in its first year, and is run by the hospitality sector

- Liverpool introduced a £2 overnight visitor charge in June. The money raised will be spent by the hospitality businesses who run the scheme, rather than the council

- Edinburgh will be the first council to charge a levy on overnight stays. After 24 July 2026 visitors will need to spend an extra 5% on top of their hotel bill for up to 5 nights

PA Media

PA MediaBill Addy, chief executive of the Liverpool BID Company which introduced the levy, said most visitors accept the levy and see it as a way to support the city's hospitality sector.

"If you go abroad… you pay a visitor charge, it's in the form of a local or a regional tax.

"You just accept it and acknowledge that it's a way of supporting the businesses that you are benefiting from."

Mr Addy stressed that collaboration with businesses was key.

"Speak to the hoteliers, speak to the businesses that are on the frontline… when you do that, the answer comes back positively."

He warned against councils using the money to fill budget gaps.

"Businesses need to control the money to prevent local authorities using it to backfill the reduction in services."

Liverpool's levy has helped fund major events such as world boxing and the UK chess championships, and Addy said the aim is to "encourage tourism and spread the peaks" throughout the year, rather than restrict visitors.

Steven Hesketh, CEO of Savvy Hotels and vice-chair of the Liverpool accommodation BID, said the levy was introduced because Liverpool was "a very vibrant event-driven city" that relied heavily on leisure and tourism.

"You cannot bring big-scale events to a city without it costing substantial fees," he said.

"The businesses have had to collectively come together, create a business improvement district which allows them to put funds to such big events to help us fill our rooms."

Mr Hesketh said the scheme, which switched to charging visitors in June, had been well-received.

"People understand we are in an international city. Liverpool is such a well-known brand globally that actually no matter where you travel in the world now – Vegas, Paris etc – all the big cities do ultimately charge some sort of tax or fee."

Hesketh said the levy is expected to raise £4.5m a year, delivering a return worth "many times more" through major events.

With Cardiff likely to be the first Welsh authority to introduce a visitor levy, accommodation providers and other council areas will be watching its progress with interest.